Help Questions

We do not have safety deposit boxes at any of our locations.

Fort Financial belongs to the CO-OP Shared Branch Network, allowing you to make deposits and withdrawals to your Fort Financial accounts at more than 5,000 participating CO-OP Shared Branches nationwide. Visits our Locations page to search for you your nearest CO-OP Shared Branch location.

View our eStatement FAQ for more details.

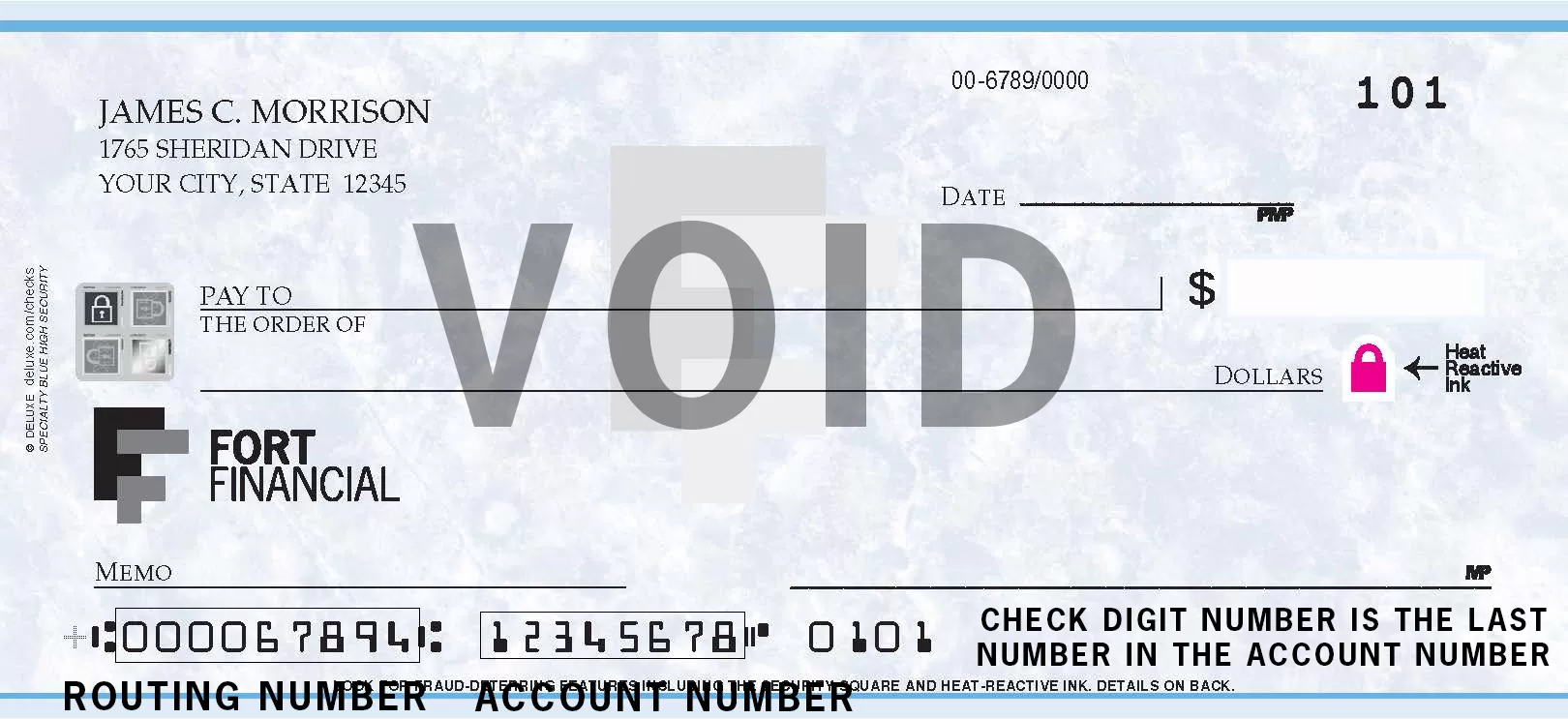

Fort Financial members can order checks through Deluxe. You can also order checks by signing into online/mobile banking and selecting your checking account, and then the "Order Checks" widget. Please call us at 260.432.1561 option 3 if you need help ordering checks.

- To report a lost or stolen card (ATM, credit or debit) call 260.435.5124.

- You can also turn your debit card on and off through online and mobile banking by going to My Cards from the main menu. This feature allows you to deactivate your debit card for any reason without issuing you a new card. You can enable your debit card once you are ready to begin using it again.

Check out the telephone banking page for more information and a menu guide.

Refer to our holiday schedule for a list of holidays we observe annually.

Review the fee schedule for a list of account and service fees you could incur.

Our member rewards program assigns you a relationship level each month that gives you special incentives and discounts just for maintaining minimum balances and active accounts with us.

View our online and mobile banking FAQ for more information.

View our online application FAQ for more information.

View our online application FAQ for more information.

View our online and mobile banking FAQ for more information.

NOTE: A text messaging and/or data plan is generally recommended, as data usage can become expensive for heavy users without a plan. For lighter usage, a “pay-as-you-go plan” may be more economical for some members. Check with your wireless carrier for more information.

The routing number (274973374) is the first set of numbers on your check. The second set of numbers is your account number.

Visit our Online/Mobile Banking FAQ page for help regarding remote check deposit.